The Challenge

A central banking organization was seeking to more effectively fulfill its mission of administering monetary policy through the implementation of an enterprise approach to Knowledge Management (KM). Specifically, the Bank was seeking an understanding of their current KM practices and a global strategy to realize: greater collaboration amongst its business areas; increased knowledge transfer and knowledge retention during all stages of the employee lifecycle; improved productivity; and improved ability to leverage learnings and best practices from across the organization to support innovation as well as staff’s professional development. The Bank faced a number of KM-related challenges that were causing inefficiencies and resulting in a greater drain on already limited resources (e.g., time, people, and budgets). On a daily basis, staff were having difficulty:

- Identifying points of contact, experts, or someone with a specific skill set, especially if those individuals fell outside their business area.

- Obtaining the procedural and contextual knowledge that people have used to arrive at final documents (e.g., their reasoning, algorithms, methods, processes, historical contextual knowledge they have acquired, etc.) in order to inform future decision-making and, when necessary, ensure coherence in guidance or advice that they’re giving.

- Finding, discovering, and accessing information, as well as determining what information they can and cannot share across business areas, given that protective measures are in place to prevent the confidentiality and integrity of information from being compromised.

- Collaborating simultaneously on critical documents.

- Onboarding efficiently and effectively trainees, contractors, and subject matter experts, who are brought on for shorter periods of time.

The Solution

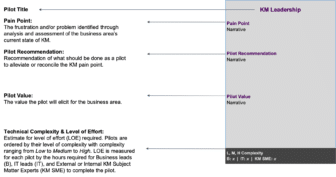

Over a six-month period, EK performed a variety of activities to achieve a holistic view of the Bank’s culture and KM-related practices, and develop recommendations to mature the Bank’s KM capabilities. EK’s knowledge gathering and discovery work resulted in a series of detailed analyses and strategies for the Bank including a KM Current and Target State Assessment, and a highly contextualized, task-based Roadmap to achieve the Bank’s desired level of KM maturity. In addition, EK provided each of the Bank’s business areas, which range in size from 20 to 350 employees, with their own Knowledge Mapping report. These customized reports featured an analysis of KM strengths and weaknesses specific to each business area along with recommendations on how they could expand current initiatives within their scope and control to further knowledge management within their area of the organization (while ensuring alignment with the enterprise KM Strategy).

The EK Difference

In seeking to understand the Bank’s KM challenges both at an enterprise and business-area level, EK deployed several strategies. EK held interviews with over 150 individuals (who represented a mix of seniority, job tenures, and functions) and facilitated 25 focus groups to gain an in-depth understanding of the current KM landscape at the Bank from a wide array of perspectives. Moreover, EK conducted an organization-wide survey to capture a representative sample of KM opinions and observations regarding existing strengths, weaknesses, opportunities, and risks related to KM. To help EK understand the advantages and challenges of the Bank’s KM ecosystem, EK reviewed existing documents, policies, and guidelines, and directly interacted with key technologies supporting KM and collaboration. Along the way, EK held Sprint Reviews every two weeks that were open to all Bank staff to keep people aware of our findings and progress throughout the duration of the project, provide transparency into the work we were doing, and capture feedback that helped inform future iterations of our work.

To help contextualize the Bank’s current and target states of KM maturity, EK leveraged its proprietary KM Maturity Benchmark, which is organized into the five categories of People, Process, Content, Culture, and Technology. EK’s KM Maturity Benchmark is based on experience with hundreds of organizations belonging to diverse industries around the world. EK leveraged the aforementioned information gathered to determine both current state and target state scores on over 40 critical KM factors for the Bank. A score of 1 corresponds to a nascent KM practice and attributes that are nevertheless behind, or below, industry standards. A factor scoring of 5 corresponds to a mature, robust, industry-leading KM practice. The benchmark scores provided the Bank with an understanding of which factors were impacting KM the most across the organization, along with strengths they could leverage.

The Results

The initiative resulted in a clear understanding of the Bank’s current state, and a shared, detailed, vision amongst the Bank’s senior leadership and stakeholders for what the Bank could and should be doing with KM. Moreover, the effort resulted in a strong consensus regarding next steps for KM transformation, broad support for a multi-year investment, and the understanding of returns on investment to expect from the transformation.

At the close of the initiative, EK delivered an assessment of the Bank’s current KM capabilities along with recommendations that aligned the Bank’s organizational needs for KM with their strategic objectives. Included within the recommendations were opportunities for alignment across business areas whose work directly supports and impacts one another. EK’s recommended KM Strategy and Roadmap will support the Bank in:

- Gaining alignment amongst staff on the Bank’s KM challenges and priorities.

- Developing metrics, actions, and messaging that leadership and staff can utilize to facilitate the adoption of KM initiatives.

- Standardizing processes to capture and leverage knowledge held by staff, resulting in improved knowledge retention and transfer.

- Enhancing KM technologies to enable staff to quickly and accurately find people, documents, and other enterprise resources from across the Bank’s systems and repositories.